How Do P2P Lending Platforms Work?

Applying for a loan is not a simple procedure today. It can take a long time from the application to the approval of the application, and in the meantime, you may lose good opportunities. There are a number of procedures and paperwork at banks and financial companies to finally get the money you need. This can be a long and arduous process. And the chances are high that you will be rejected for the application you have submitted. If the bank thinks that you are not creditworthy enough to approve your application, then you will certainly be rejected.

In such difficult times, it is hard to be dependent on an institution that can meet our needs. But now such problems have come to an end because there is another way to get the money you need. If you focus on further reading this article you will discover what is the easiest way to get the loan you need today, and how to make it available to you in the shortest possible time.

What is a peer-to-peer platform?

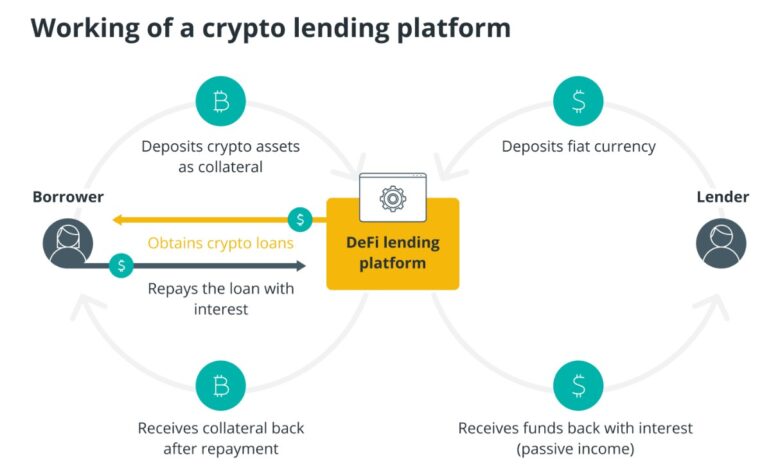

These websites are a kind of marketplace where on the one hand there are people who are investors and on the other hand, there are people who need loans. And the platform is a kind of intermediary that connects the two sides. Borrowers can be both businesses and individuals, and the same can be found with loan seekers, and businesses and individuals can do just that. The platforms differ in that in some of them the lenders can choose to whom they have transferred their funds, and in other websites of this type, the funds invested by the landlords are automatically distributed to those who are applying for the loan.

For all those who have excess financial resources for disposal, they can opt for such an investment which has a great benefit from it. If you are in the role of a lender, you can invest your money in such a platform, and in return receive an interest rate that will be offered to you by the website, or you can choose for yourself what the interest rate would be. When it comes to lending, there are several steps you can take to begin the process of preparation for mediation.

The first step is to choose the ideal site where you could do it, and our suggestion is to do it on p2pincome, where you are offered one of the best platforms that exist for peer-to-peer landing. Once you have selected the platform that you think is the best, the next step is to create an account where you can transfer the funds you want to invest. Once you have selected the amount you want to transfer to your account, you will be offered the opportunity to choose how much interest you want the amount of money you transfer to be, ie how much you would like to earn from the money you lend to someone. Finally, you need to choose the fixed period for which you want your money back, whether it is for two, three years or more. As, one of the best benefits we can share with you is that as a lander you can earn a lot more than if you were to decide on a different way of investing money.

On the other hand, in the case of a loan applicant, the process would be followed. Just like the lender, he chooses the platform where he would apply and provide all the necessary information about the amount of funds he needs. His application is processed immediately, the risks are determined, and the credit rating as well as the interest installment he has to pay. Once his application has been approved, they link him to the appropriate lender and offer him options created specifically for the applicant.

He has to decide which option is most suitable in terms of his requirements as well as his creditworthiness. His duty after choosing the ideal option is to pay monthly interest payments and repay the original loan amount. On the plus side, applicants can quickly and easily get the funds they need because they would be linked to an ideal lander, but the downside of these platforms is that they are not regulated by the government, so you should be willing to take risks if you make such a decision.

Benefits and disadvantages

These platforms offer great services and create contacts between the two parties and allow them to achieve their goals. However, there are advantages and disadvantages for both the lender and the applicant. Therefore, both parties should be extremely careful when deciding on such a step. Part of the risks that landers can expect is, that the borrower may not be able to repay the funds lent to him by the individual or business, the platform may shut down and because they are not regulated by the government there is no kind of insurance that would take effect and allow the lander to recover the funds. There may also be a situation where the borrower can repay the money that was available to him in advance, so in such cases, the chances of making a profit are lower. Or the applicant may be late with the monthly installments.

I hope you now have a clearer picture of how these websites work. If you need a loan, all you have to do is create an account on one of the platforms, and the people who work there will find the right lender for your requirements. If you want to earn some more dollars, and you have money with which you do not know what to do with it, then we strongly recommend you to invest them in one of these websites where you would have a chance to earn much more than if you invested in crypto or on the stock exchange. If you are wondering where to do this, all you have to do is click on the link above which will take you to the right websites for this purpose. Another small tip from us, and that is if you are given a chance, choose for yourself to whom you would give the money to in order to make sure that it is returned to you.